In my days with HomeNet Automotive, a new feature was released that allowed our customers to upload live video into their inventory for distribution to the third-party websites that would allow it.

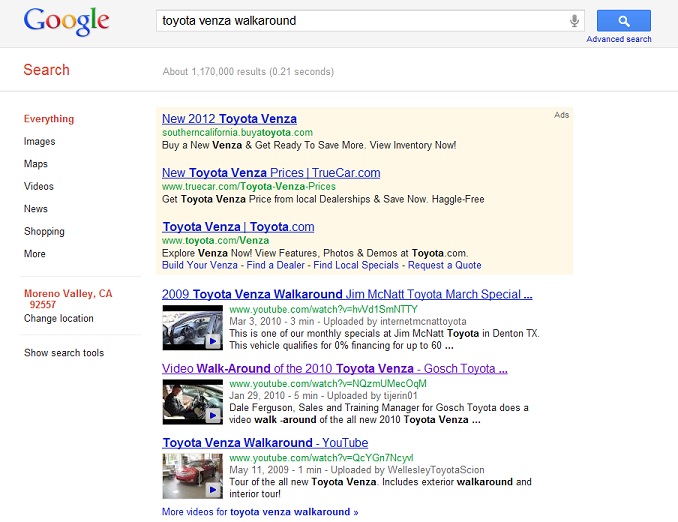

Imagine if this video had actually been a part of that dealer’s actual inventory on their website as well as all the third-party sites. Given that this was a new vehicle, it could have been added to all of the listings for this model and year vehicle in their inventory. They could DOMINATE Google searches for their brands.

The proof is in the pudding. I highly doubt the people watching these videos decided randomly to watch a video walk-around of a Toyota Venza. It’s more likely that these were consumer’s interested in that vehicle.

This is advertising GOLD and cost them absolutely nothing.

If you want to watch it, here’s the video: